March 18, 2024 | Forex Brokers

A lot of traders think that a big broker is better than a smaller one because a larger company has many advantages such as economies of scale, a better liquidity position and is the subject of higher scrutiny from the public and the regulators. While this basic assumption has some merit and to some degree "bigger is better", it is not a total correlation between size and quality of forex brokers. This means that the largest broker is not necessary the best, although all good brokers are sufficiently large in order to be competitive.

If you want to find out which are the biggest forex companies in the world, you should continue reading this article. However, if you want to know which are the best forex brokers in the world when it comes to trading conditions and customer satisfaction, you should check our special forex brokers ranking.

When it comes to measuring the size of a company, there are several criteria that are generally used. The most common criteria used in ranking companies by size are market capitalization, revenue and profits. Also, when it comes to financial companies such as banks or insurance companies, another way to measure size is by comparing the total assets under management. While these values can be relevant in some situations and industries, they are totally irrelevant when it comes to forex brokers. Here is why:

Market Capitalization - The only companies that can be ranked by market capitalization are public companies (those listed on a stock exchange). This would leave most forex brokers out of the ranking. It is also important to note that market capitalization represents the value investors give to a specific company. A small but profitable company can have a higher market value than a large company unable to generate profits.

Revenue - While ranking forex brokers by revenue will render more accurate results, this criteria is still far from being relevant in this particular case. A broker's revenues will come from the commissions it charges and the spreads the traders have to pay. A broker with higher commissions and spreads will generate more revenue than a similar sized broker with lower spreads. There is also the problem of integrated products offered by the companies. A company offering stocks trading, options and futures along with forex trading will generate revenue from more sources as compared to a pure forex broker. If the stocks business generates most of the revenue, the company can be very large but the forex division can still be small compared to others.

Profits - Ranking forex brokers by profits is totally irrelevant, as this criteria includes the same problems we identified when discussing about revenues, and many more. Just think about a large company with a bloated business that has huge operating costs. It can be a really big company but generate no profit.

Assets Under Management (AUM) - In the case of forex brokers, the closest thing to AUM are the client funds. While they are not managed by the brokers, they represent the total value of the client accounts. This measure is much more relevant than the previous ones, but it still lacks the differentiation between the forex business and the other services offered by the company. If you mix stocks trading with forex, it is very likely that the largest part of the client funds will be used in trading stocks, not forex. Another thing that makes clients funds less relevant is the different leverage used by brokers. Lower leverage needs more funds in the broker's custody for the same operations. Also, it is possible to have large forex accounts with very little trading activity.

Considering the above mentioned criteria are irrelevant when judging the size of forex brokers, we must come up with a measure that is more relevant to this specific business. In this case, we think that the most relevant criteria to rank forex brokers is by the average volume of daily transactions.

Average Volume of Daily Transactions (AVDT) - The daily transactions of a forex broker can vary a lot, but the more active clients the broker has, the less volatile the value of daily transactions will be. In order to get a better idea about the real volume of a broker, it is better to calculate the average volume for a larger period of time, as daily and seasonal fluctuations will be less relevant. We think the AVDT becomes relevant when at least the last three months are being taken into consideration when calculating the average. In order for a forex broker to be considered large it must have an AVDT of at least one billion dollars (more than 10,000 standard lots traded daily).

We noticed that all the high quality forex brokers are also large ones and have their AVDT of at least three billion dollars. This is why, in this article we will list only brokers with daily transactions exceeding three billion US dollars.

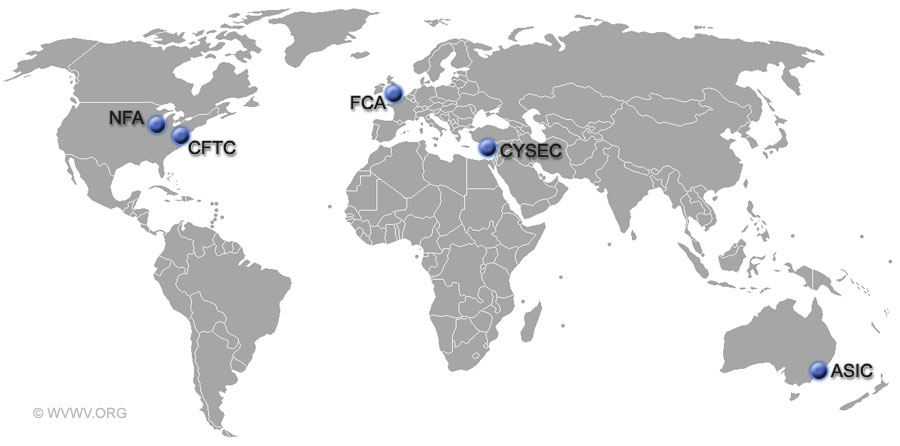

Below you will see the biggest forex companies in the world by volume of daily transactions. We have separated the companies based on their location, as we have identified four major regions when it comes to forex brokers: United States of America, Europe, Australia and the Rest Of The World. The regions we identified have different regulation and the brokers in each region must abide by specific rules. The data presented on this article was compiled from different sources such as company presentations and other information found on the internet. The data is not audited and we cannot guarantee it is accurate. Please take the information about AVDT with a grain of salt as it may contain errors and inaccuracies.

Figure 1: Major forex regulators around the world

In order to make it easier for you to identify the best forex brokers from the rest, we have also added our rating next to each broker. The ratings vary from A+ (best) to C- (Worst). We have a dedicated page where you can read more information about our forex broker ratings.

The United States is one of the largest forex markets in the world, but due to very restrictive regulation it has been declining in recent years. It is also the most isolated market since US traders are unable to open account with offshore forex brokers because the FATCA regulations imposed on foreign financial institutions has made it too expensive for anyone to accept US clients.

The strict rules and protection from outside competition had led to consolidation among local brokers, with the most important development being the acquisition of FXCM client base by Gain Capital (also known as Forex.com). Right now there are only three forex brokers in the United States, and one of them is mostly an institutional broker (Interactive Brokers), so retail clients have basically only two choices (Forex.com and Oanda). Because the CFTC and NFA regulation greatly limits leverage and has the unpopular FIFO rule, the US based brokers have been unable to get traction in foreign markets and the vast majority of their clients are from the US.

Below is the ranking of the biggest US forex brokers by volume:

| AVDT* | Rating | Broker |

| 9.3 | B- | Forex.com (GAIN Capital Holdings Inc) |

| 7.5 | B+ | Oanda (Oanda Corporation) |

| 2.9 | C- | Interactive Brokers (Interactive Brokers LLC) |

* Average Volume of Daily Transactions in Billion USD

This is where most of the large forex companies are located. Because of Europe's cultural and linguistic diversity, local brokers had to adapt early to very different markets and stiff competition, but this has proven to be a great asset when they expanded globally. European brokers are based in different countries and have multiple trading licenses, but the hot spots of forex trading in Europe are Cyprus (CySEC) and the United Kingdom (FCA). This is where most brokers are located thanks to the world leading regulation, and even brokers located in other countries such as Denmark's Saxo Bank use a CySEC license for their forex trading division. While European regulation varies from country to country, they are all compliant with the MIFID legislation of the European Union which adds another layer of protection for traders.

Some of the European brokers have gone global, and their operations are spread on different continents. European brokers are used by many traders in Asia, Africa, The Middle East and Latin America, and their total volumes are greatly boosted by their international operations. Some brokers may have the bulk of their activity from non-European clients attracted by the safety of European regulations and the excellent trading conditions offered by some of the world's leading brokers.

Here you can see the largest forex brokers in Europe:

| AVDT* | Rating | Broker |

| 21.3 | A- | Ava Trade (Ava Trade Ltd) |

| 16.1 | A | XM Group (Trading Point of Financial Instruments Ltd, Trading Point of Financial Instruments Pty Ltd and XM Global Limited) |

| 11.2 | B+ | FXTM (ForexTime Limited) |

| 9.4 | B | Saxo Bank (Saxo Bank A/S) |

| 6.9 | B- | IG Markets (IG Group) |

| 6.5 | C | FX Pro (FxPro Financial Services Limited) |

| 4.8 | B+ | Swissquote (Swissquote Group Holding SA) |

| 4.7 | B- | Plus500 (Plus500 Ltd) |

| 4.5 | C- | Etoro (eToro Europe Ltd) |

| 4.2 | C | Markets.com (Safecap Investments Limited) |

| 3.9 | B- | CMC Markets (CMC Markets UK plc) |

| 3.8 | C+ | FXCM (FXCM Group) |

| 3.5 | B | Dukascopy (Dukascopy Bank SA) |

| 3.3 | B- | FXDD (FXDirectDealer LLC) |

| 3.2 | C+ | Admiral Markets (Admiral Markets Group AS) |

* Average Volume of Daily Transactions in Billion USD

Figure 2: Costas Cleanthous, XM's CEO at the Shanghai Forex Expo

We have a separate section for Australian brokers because they have their own regulation under the Australian Securities and Investments Commission (ASIC). Australian brokers are well represented outside Australia's borders as well, because the jurisdiction is very solid and some of the brokers are offering top notch conditions and liquidity. The major forex brokers in Australia are also very successful in other English speaking countries as well as in China and Southeast Asia.

There are three major Australian forex brokers that generate very high average daily volumes, and all of them are experiencing good growth rates. Below you can find the largest forex brokers in Australia:

| AVDT* | Rating | Broker |

| 46.6 | A+ | IC Markets (International Capital Markets Pty Ltd, Raw Trading Limited) |

| 12.8 | A- | Pepperstone (Pepperstone Group Limited) |

| 5.7 | B | AXI Trader (Axitrader Limited) |

* Average Volume of Daily Transactions in Billion USD

There are several high volume forex brokers located in other jurisdictions than the ones presented above (Australia, Europe and United States). Since the remaining big brokers are spread around the world and are not concentrated in a smaller region, we have included them in the "rest of the world" category. The brokers listed here come from very different jurisdictions such as St. Vincent and The Grenadines, Belize, British Virgin Islands or Cayman Islands in the Caribbean, Seychelles or Bermuda. It is important to understand that even the brokers based in Europe, Australia or the US have separate licenses from countries like Belize and Seychelles which offer more flexibilities for their international traders.

The brokers in this category abide by different regulation and can vary a lot when it comes to reliability. However, this does not mean that such brokers cannot be good, as you will see that the ratings they received are very different, from very good to very bad. When regulation is more permissive, it gives the broker more freedom which can be both a positive or a negative depending on how each brokers chooses to use this freedom. This is how Exness has managed to become the world's largest forex broker by far, as it used its freedom to offer better trading conditions than what stricter regulations allowed.

Here is the list of the largest forex brokers from the rest of the world:

| AVDT* | Rating | Broker |

| 130.4 | A+ | Exness (Exness Limited) |

| 14.2 | A | HF Markets (HF Markets Ltd) |

| 10.1 | A- | IFC Markets (Ifcmarkets Corp) |

| 8.2 | B+ | M4 Markets (Trinota Markets Global Limited) |

| 7.8 | B | Instaforex (InstaForex Group) |

| 6.7 | B | Vantage FX (Vantage International Group Limited) |

| 5.7 | B | Eagle FX (EagleFX Ltd) |

| 5.5 | B | Iron FX (Notesco Limited) |

| 4.8 | B- | X-Trade Brokers (Xtrade International Limited) |

| 4.5 | B | IQ Option (Iqoption Ltd) |

| 4.3 | B- | FX Open (FXOpen Markets Limited) |

| 4.2 | C | Easy Markets (EF Worldwide Ltd) |

| 4.2 | C- | Roboforex (Roboforex Ltd) |

| 4.1 | B | Olymp Trade (Inlustris Ltd.) |

| 3.8 | C- | Alpari (Alpari Limited) |

* Average Volume of Daily Transactions in Billion USD

While US traders will have to settle with a US based broker since they are not allowed to open accounts with foreign companies, people from the rest of the world are free to trade using an offshore forex broker account. In most cases, Europeans will settle for an European broker and Australians will choose a local one as well, but what about people from the rest of the world? What about people in Canada, Central and South America, The Caribbean, Africa and Asia? They make up more than 85% of the world population, and they must choose a foreign forex broker to trade with. What are their best options?

All forex brokers will accept people from most countries, but only a small number of brokers are truly able to handle a diverse client base. In order to better serve people from various countries and continents, a broker must be able to easily handle deposits and withdrawals with a vast number of internationally used payment methods. The brokers must also allow for accounts denominated in different currencies, have multilingual websites and dedicated customer support for many countries and languages. The brokers targeting a worldwide audience may hold multiple licenses and operate in different jurisdictions in order to provide the best trading conditions for people in different regions. While many of the big forex companies are specialized in serving more than one demographic, we have identified a set of brokers which have a truly global presence and are well suited to handle traders from any corner of the world.

Here are the largest truly global forex brokers:

| AVDT* | Rating | Broker |

| 130.4 | A+ | Exness (Seychelles, Curacao, British Virgin Islands, South Africa) |

| 46.6 | A+ | IC Markets (Australia, Seychelles) |

| 21.3 | A- | Ava Trade (Ireland) |

| 16.1 | A | XM Group (Cyprus, Seychelles, Belize) |

| 14.2 | A | HF Markets (St. Vincent and The Grenadines, Cyprus, South Africa, Seychelles, Mauritius) |

| 12.8 | A- | Pepperstone (Australia, Bahamas, United Kingdom, Kenya) |

| 11.2 | B+ | FXTM (Cyprus, United Kingdom, Mauritius) |

| 10.1 | A- | IFC Markets (British Virgin Islands) |

| 9.4 | B | Saxo Bank (Denmark) |

| 8.2 | A | M4 Markets (Seychelles) |

| 7.8 | B | Instaforex (British Virgin Islands) |

| 6.5 | C | FX Pro (United Kingdom) |

* Average Volume of Daily Transactions in Billion USD

Disclaimer: The average trading volumes presented on this page are the result of out efforts to gather and compile information from different internet sources. We have no guarantee that the numbers are correct, and considering the volatility of the forex market and the seasonal dynamics, it is possible that such numbers will suffer significant changes from month to month. Please also note that the ratings we give to forex brokers are based on our own research and criteria, but do not represent an endorsement or a critique of any broker. We are not giving investment advice and we think anyone should do his/her personal due diligence before registering with a specific broker. Forex trading is a risky activity and you should never trade with money you cannot afford to lose.

► Best Forex Brokers for Large Accounts

Choosing a forex broker can be a very daunting task because the number of available options is overwhelming. With so many brokers advertising themselves as being the best, people go to specialized websites to read reviews and see broker rankings hoping they will find which broker is their best choice... Read More

Since there is a lot of confusion among retail traders about the overall quality of forex brokers, we have decided to create an advanced rating system and evaluate all the major forex brokers in the world according to the same set of criteria. Because we are aware that it is impossible to evaluate all forex brokers... Read More

► Volatility 75 Index Brokers & Strategy

In order to trade the Volatility 75 Index, you need a high quality broker that offers the VIX among its trading assets. We have gathered a list of the best Volatility 75 Index brokers that accept traders from South Africa and.... Read More

► Offshore Forex Broker Account with Debit Card

There are many reasons why people decide to open bank accounts offshore. They can include a better privacy protection, access to better banks where money are safer or simply better services that home based banks don't offer. The same reasons apply when it comes to brokerage accounts... Read More