November 16, 2016 | Binary Options Brokers

Social Trading is the raising star of the online trading world, with more and more people discovering the opportunities of harnessing the power of crowd intelligence. With new advanced platforms that allow traders to interact with each other and copy the trades of the most successful ones, this new trend may soon transform the financial trading industry forever.

In this article we will analyze this increasingly popular phenomenon and see if there is a real opportunity in it.

Social trading is the concept of organizing traders in an environment very similar to a social network where they can interact with each other and gather information from one another. Since social networks are extremely popular and people are very familiar with this concept and seem to embrace it in many different ways, from keeping up with friends to sharing photos and videos, it was expected that a social network for traders will soon emerge.

What is special about social trading is that not only traders can exchange information between one another, but they can also copy each other's trades and execute it automatically, resulting in the phenomenon named copy-trading.

But is this beneficial to traders, can it result in a higher winning rate and more profitable trades? The short answer is yes, and the main reason behind it is crowd intelligence.

Crowd intelligence, also known as "the wisdom of the crowd", represents the median opinion of a group of people as compared to a single individual's opinion. For example, if you ask different people a simple question like "What is the size of this shoe?", the median answer is likely to be extremely close to the correct size. While an individual may greatly misjudge the size and give am out-of-touch answer, the more people you ask, the more accurate the median answer will be.

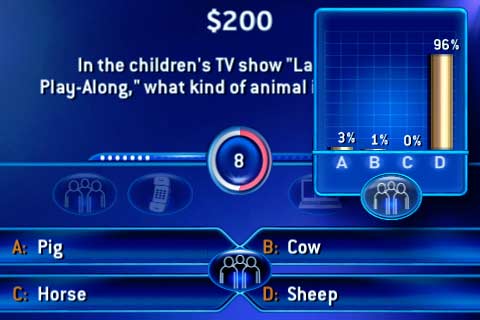

A very common way to use crowd intelligence (CI) that everyone knows about is the famous "Ask the Audience" option in the "Who Wants to be a Millionaire" contest. In most cases asking the audience results in the correct answer, and statistically it has a much higher chance of indicating the correct answer than just randomly choosing an option. The logical question resulting from here is: if the wisdom of crowds can find the correct answer better than a coin toss, can it also predict if the Euro is going up against the US Dollar?

Figure 1: Ask the audience in Who Wants To Be A Millionaire 2010 game

Before the internet and the huge advance in communication technology that swept the world in the last few years, traders had only two options when they wanted to predict the market movements with a better accuracy than a coin toss: technical analysis and fundamental analysis. With technical analysis they applied various statistical indicators on charts and tried to predict the future movements of an asset based on previous movements and historical data, based on the idea that markets are cyclical and patterns tend to repeat themselves. On the other hand, fundamental analysis relies on economic indicators and other information like news, Central Bank policies or even politics to predict where the market will go.

While fundamental analysis is usually correct when it comes to long term trends, it is almost useless when it comes to short term movements and day trading, so high frequency traders had only technical analysis to rely upon. Since technical analysis is a mathematical and statistical way of looking at the market, the best way to do it is through a computer algorithm that generates buy and sell signals when a group of indicators reach a certain level that normally predicts the direction of the price movement. Such algorithms are used in both forex trading (they are called Expert Advisers) and binary options trading (they are known as binary options robots).

But since social networking has put people from around the world together in a way that has never been seen before, it was a question of time before some smart people would try to use this to harness the power of Crowd Intelligence and use it for trading currencies and other assets. With the help of the Social Trading Networks, traders can now use a new set of tools when it comes to forex and binary options trading that was never available before:

Copy Trading - Automatically replicate the trades of another investor.

Crowd Sentiment - See what is the sentiment among fellow traders regarding a specific asset. If the vast majority of traders are going short, it may be the time to sell.

People Portfolio - This may sound bizarre, but social trading has brought diversification to a new level. You can now have a portfolio of traders that you automatically copy-trade. This way you spread the risk of one trader doing it wrong and benefit from the two greatest strengths of social trading: copying from the best traders and not only from one, but from many, so you can also harness the power of the crowd, in this case an elite crowd.

The few social trading networks that exist so far have not been able to create profitable trading opportunities. This is mostly because they are targeted to novice traders, and having a large number of inexperienced people trying to beat the market together will not work in most situations.

The closest thing to "social trading" that can actually work is the so called "copy trading" function of some professional forex brokers. This is usually when a system of PAMM (Percent Allocation Money Management) is created when traders can automatically copy the trades of somebody else in a proportional manner in their account. The most successful PAMM system that allows automatic copy-trading and gives traders the opportunity to choose which traders to copy based on previous results is offered by the broker Hot Forex. You can find more about it on their website.

Social Trading is a new trend in online trading that is here to stay. You will hear more and more about crowd intelligence trading, copy-trading and other concepts related to social trading, and more brokers are likely to try to develop their own social trading networks to take advantage of this new phenomenon. While the crowd wisdom can help traders get better results, it is important to keep in mind that trading forex or binary options involves risk and past results do not guarantee future performance. This means that copying a trader who achieved positive results in the past is not a guarantee that the future results will be the same. Some trading strategies can work very well under certain market conditions, such as during calm markets or during strong trends but can fail when market fundamentals change. This is why we always advise traders to diversify and never put all eggs in the same basket. And don't forget that you should never trade with money you cannot afford to lose.

3. The Wisdom of Crowds: Why the Many are Smarter than the Few